Industry News

Oil and Gas Industry News and Information

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.

Garrett Phelan

CEO of US Mineral Exchange with over 27 years of experience in the oil and gas industry. For nearly two decades, he has helped individuals, families, trusts, and non-profits navigate the complexities of mineral and royalty rights to achieve the highest sale prices.

Widely recognized as an industry expert, with an unwavering commitment to a client-first philosophy and extensive industry knowledge, he has been featured in Hart Energy, Yahoo Finance, and the Permian Basin Petroleum Association magazine.

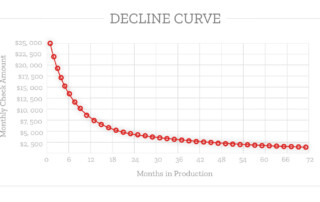

Oil and Gas Decline Curves in 2025

What is an Oil and Gas Decline Curve An oil and gas decline curve is an estimate of amount of production from a well. While all wells are different, the production from a well will follow a very similar path. Each well starts out with a lot of production, [...]

Mineral Interest Types Explained

Example 1: Non-Participating Royalty Interest Example 2: Royalty Interest Types of Mineral Interest Ownership As a mineral owner, there are several types of ownership you may have. Below are the most common mineral interest types, along with the abbreviations used in the oil and [...]

Force Mejeure Impacting Mineral Owners

Force Majeure Clauses Force Majeure – According to Legal Information Institute, Force Majeure is a contract provision that frees parties from obligation to each other if an extraordinary event prevents either party of an Agreement, in this case the Oil and Gas Lease Agreement, from performing. The event must [...]

Negative Oil Prices Impact on Royalty Checks

Why are oil prices negative? As we discussed in our recent Coronavirus article, there are a couple of things working together to tank the price of oil. The first is demand. With Coronavirus bringing the US economy to stand still, there is very little demand for oil. Many people are [...]

Coronavirus Impact on Mineral Rights

Coronavirus Impact on Oil and Gas Demand The biggest near term impact on that Coronavirus has on mineral rights is in the demand for oil and gas. As a mineral owner, the amount that you get each month from oil and gas royalties is tied to the current [...]

Mineral Rights and Medicaid Eligibility

The information provided in this article is for informational purposes only. US Mineral Exchange is not liable or responsible for any party who uses or relies on this information when applying for or being approved/denied for Medicaid. The information provided below is simply our opinion of matters related to [...]

Lowest Rig Count since 1949

Contact US Mineral Exchange: If you have questions about your mineral rights, we’re here to help! We speak with mineral owners every day and we look forward to hearing from you. Please don’t hesitate to fill out the form below with any questions and our friendly team will [...]

Where to Buy Mineral Rights

Why US Mineral Exchange There is a reason that new buyers sign up every single day at US Mineral Exchange. When buyers are looking for where to buy mineral rights they consistently turn to us. There are a few reasons for this: Direct Seller Contact: One of the [...]

Price of oil stagnates

Sell Royalties for a lump sum If you want to sell royalties and get a lump sum you can avoid the fluctuating price of oil. When you sell royalties it allows you to pocket a guaranteed amount of cash. This means you don’t have to worry about the price of oil. [...]

Oil Surges 8% Higher

Oil Prices have far reaching effects The price of oil is having an immediate impact across the industry. Operators are being forced to reduce their capital expenditure. This means less rigs are operating. With less rigs comes a decrease in the demand to lease mineral rights. Operators are [...]

Popular Content

- Sell Mineral Rights

- Mineral Rights Value

- Calculate Value

- Market Value

- Mineral Rights Buyers

- Mineral Rights Appraisal

- Mineral Rights Brokers

- Should you Sell Mineral Rights

- Never Sell Mineral Rights

- 10 Helpful Tips

- Mineral Interest Types Explained

- Common Mistakes

- Mineral Rights & Taxes

- Medicaid & Mineral Rights

- Common Q&A

Free Consultation

Free Consultation

Common Questions

The more information you can provide about your property the better! We can give you a better idea about the value of selling mineral rights if you provide more information. The most important thing we need is for you to answer the questions and provide your state and county.

If you have the required documents to list, providing those is extremely helpful!

Absolutely not! When you inquire at US Mineral Exchange we will not be putting any pressure on you to sell. We will help answer any questions you have whether you are interested in selling or not.

At US Mineral Exchange, we take privacy very seriously. We will NEVER sell your information or use it without your consent. When you send us documentation or tell us about your property, that information does not go outside our company without your consent. Even when you list a property for sale on our website, we strictly control who has access to the information about your listing so that only legitimate buyers will be able to see property details.

Many mineral owners make the mistake of getting an offer and quickly selling. They then accept an offer far below market value because they felt pressure to sell. There is nearly always a better price available.

Imagine you were selling a home. Would you get the best price from a random person who walks up and makes you an offer? No way! Now imagine you list the home on the MLS where thousands of potential buyers know your house is for sale. The key to getting the best price is competition. Our guide to selling mineral rights explains everything.

The reason that so many mineral owners decide to sell mineral rights at US Mineral Exchange is access to our large network of mineral rights buyers. Our goal is to help you get top dollar for selling mineral rights by getting your property in front of a huge audience of buyers. This allows buyers to compete against one another which ensures you get fair market value for selling mineral rights.

There are absolutely no cost to list your property. When you locate a buyer by listing your property with us, we are paid a commission directly by the buyers closing agent. This means you never have any out of pocket expenses ever. We only get paid if we can get you a better price than the current offer you have in hand.

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.