Mineral Interest Types Explained: Know What You Own

Understanding exactly what you own is essential when it comes to mineral rights. There are several types of mineral interests, and the differences can get confusing fast.

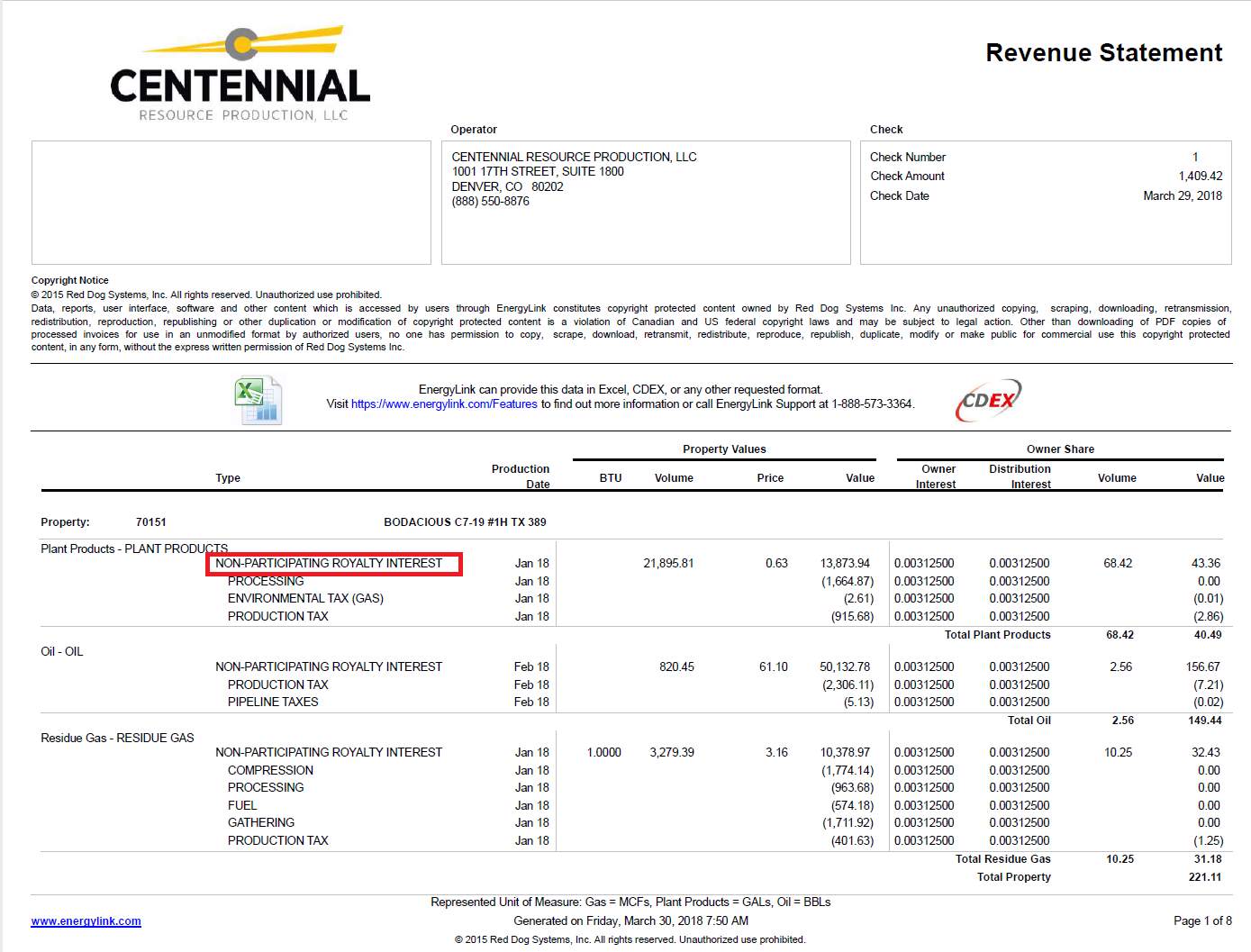

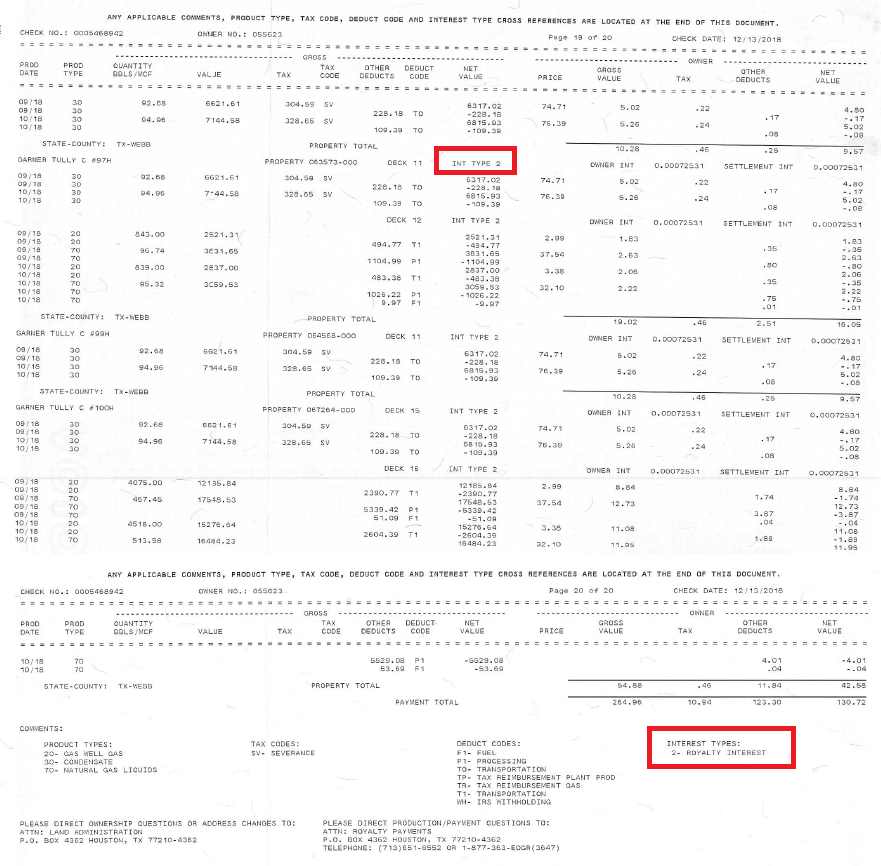

Start With Your Royalty Check Stub

If you’re receiving royalty income, your check stub is the quickest way to confirm what type of interest you own. Look for:

- A clear label of your ownership type, such as Mineral Interest, Royalty Interest, or

- Abbreviations like MI, RI, or ORRI.

Most check stubs include a key—usually at the bottom—that explains these abbreviations. Keep in mind that formats vary by operator, and not all provide clear labeling.

Need Help Figuring it Out?

If you’re still unsure what type of mineral interest you own, we can help. Use the contact form below or click the green button for a free consultation. You can upload your latest check stub, and we’ll review it for you. We’ve also included example stubs in this post to guide you.

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.

Garrett Phelan

CEO of US Mineral Exchange with over 27 years of experience in the oil and gas industry. For nearly two decades, he has helped individuals, families, trusts, and non-profits navigate the complexities of mineral and royalty rights to achieve the highest sale prices.

Widely recognized as an industry expert, with an unwavering commitment to a client-first philosophy and extensive industry knowledge, he has been featured in Hart Energy, Yahoo Finance, and the Permian Basin Petroleum Association magazine.

Example 1: Non-Participating Royalty Interest

Example 2: Royalty Interest

Types of Mineral Interest Ownership

Royalty Interest (RI): A royalty interest is the most common and “pure” form of mineral ownership. As an RI owner:

- You own the rights to the minerals (oil, gas, etc.)

- You can lease your minerals to oil companies

- You receive lease bonus payments and monthly royalty income

- You are not responsible for any drilling or production expenses

Royalty interest owners benefit from upside potential with minimal risk or liability.

Working Interest (WI): A working interest owner participates directly in oil and gas operations. This means:

- You are responsible for a share of drilling, completion, and production expenses

- You may earn more if a well is highly productive

- However, you assume the financial risk—even if the well is a dry hole

Working interests can generate high returns, but the risks are significantly higher than royalty interests.

Non-Participating Royalty Interest (NPRI): An NPRI owner:

- Has the right to receive royalty income

- Does not have the right to lease the minerals

- Does not collect lease bonuses or negotiate lease terms

This means someone else holds the executive rights to lease the minerals on your behalf.

Executive Rights: An executive rights holder controls the right to negotiate and sign lease agreements. This includes:

- Choosing whether or not to lease the property

- Negotiating lease terms (royalty rate, bonus, term, etc.)

- Collecting any lease bonus paid by the operator

Note: Executive rights do not entitle you to royalty income unless you also own an interest like RI or NPRI.

Overriding Royalty Interest (ORRI): An ORRI is a royalty interest created on top of or separate from an existing lease and does not come from ownership of the minerals themselves. Commonly:

- Created when someone leases your minerals and assigns a portion of the royalty to themselves

- ORRI only lasts as long as the lease remains active (i.e., held by production)

- You lose the interest when the lease expires or production stops.

Example: You lease your minerals to Company A at 20%. Company A then leases to Company B at 25% and keeps the extra 5% as an ORRI.

Mineral Classified (Texas Only): This unique ownership type only exists in Texas. If you have classified mineral rights:

- The State of Texas receives 50% of any royalties produced

- Your effective royalty rate is cut in half (e.g., 25% lease = 12.5% to you, 12.5% to the state)

- You must sell the surface and minerals together—they can’t be split.

This is a rare ownership type, and most owners will know if they have it.

Phases of Mineral Rights Ownership

Even if you know the type of mineral interest you have, it’s equally important to understand what phase your property is in. This determines both value and future income potential.

1. Non-Producing, Unleased Mineral Rights

You own minerals, but:

- You haven’t signed a lease

- You’re not receiving royalties

- No drilling is currently planned

These are the hardest to value. Unless you have large acreage, recently expired leases, or strong offers, these rights often have little to no market value.

Note: US Mineral Exchange generally does not list non-leased, non-producing acreage unless it’s 250+ net mineral acres or has recent offers above $50,000.

2. Non-Producing, Leased Mineral Rights

You’ve signed a lease, but no well has been drilled yet. This is a favorable position:

- Indicates that an operator may drill in the next 3–5 years

- Attracts interest from buyers

- Gives you flexibility to sell now or wait and collect royalties later

If no lease has been signed in 5+ years, assume your property is likely unleased.

3.Producing Mineral Rights

These are the easiest to identify:

- A well has been drilled

- You receive regular royalty checks

- Value is highest because income is already being generated

Producing properties are highly desirable and usually attract multiple offers when marketed for sale. Check out our article about the value of royalties to learn more about what your producing mineral rights could be worth.

Important Mineral Ownership Terms

Entire books cover oil and gas terminology, but this isn’t a full glossary. Instead, we’ve selected the key terms every mineral owner should understand.

Mineral Rights/Royalties/Property: Refers to ownership of underground oil and gas. These terms are used interchangeably and represent your personal property, even if you don’t own the surface.

Lease Agreement: The legal contract between you and an operator. It outlines:

- Your royalty percentage

- Terms and conditions

- Lease bonus amount

- Duration of the agreement

Royalty Percentage (Rate): Determines your income from production. Higher rates = more income.

Example:

- 12.5% royalty = $1,000/month

- 25% royalty = $2,000/month

Lease Bonus: One-time payment received for signing a lease. Often higher when royalty rate is lower, and vice versa.

Lease Term: All leases will have a term in effect. Typical lease terms are 3+2 or 5+5 years. If no drilling happens, the lease expires. An example could be—Primary 3 year term with an optional 2 year extenstion (3+2). Note: the option to extend is at the operators discretion.

Top Lease: A new lease signed while your current lease is still active, triggered when the current lease expires.

Surface Ownership: Owning both surface land and the minerals beneath it. Most mineral owners do not own the surface.

Right of Way: Payment for allowing roads, pipelines, or other activity on your surface property.

Oil and Gas Permit: State approval to drill. Indicates drilling might happen, but not guaranteed.

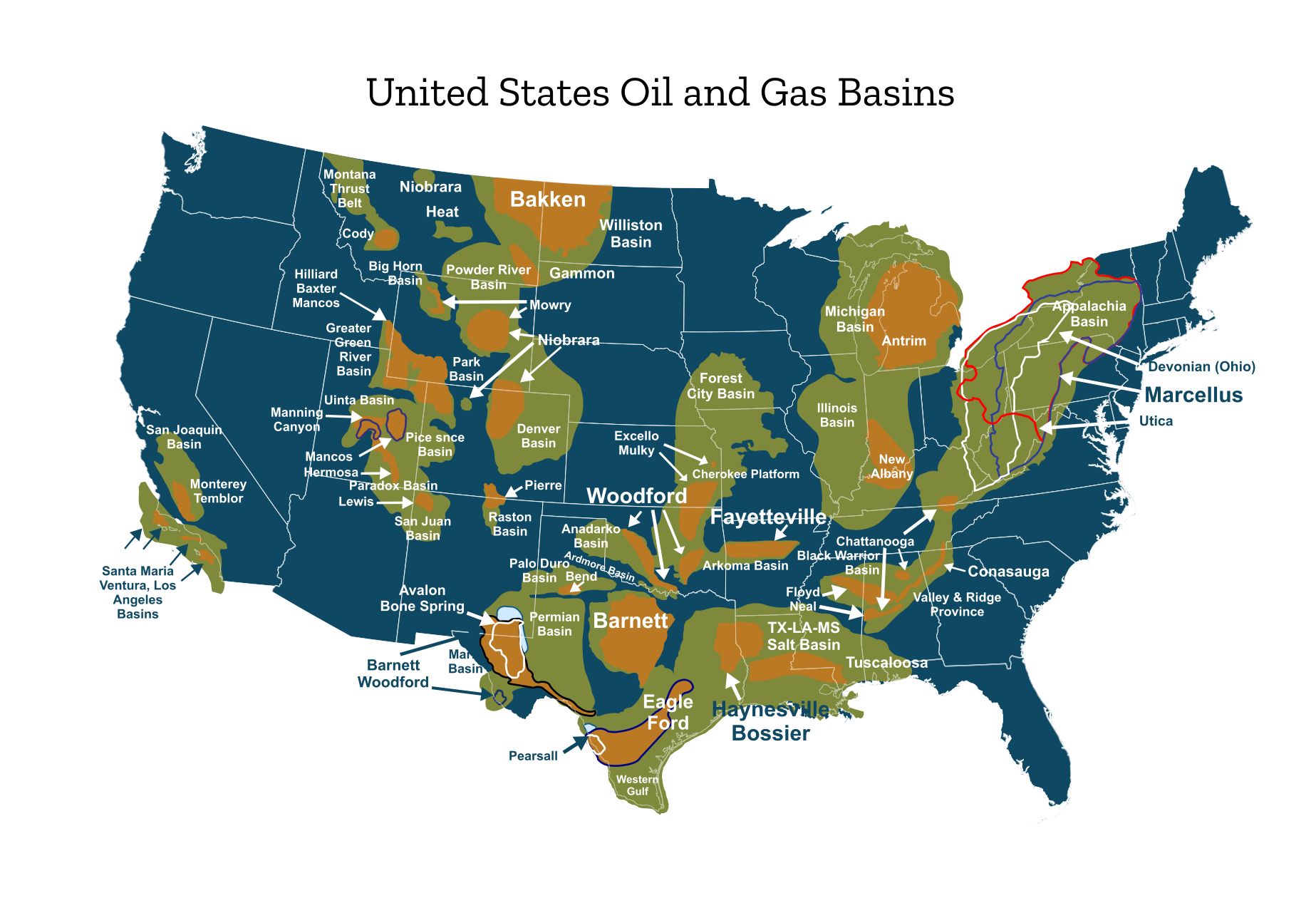

Formations: Underground layers that contain oil or gas. Like layers in a cake, each formation is different.

Oil and Gas Basin: Geographic region known for oil and gas activity (e.g., Permian Basin, Delaware Basin).

Division Order: Document confirming your ownership so you can start receiving royalties. Must be signed to get paid.

Revenue Statement / Check Stub: Your monthly payment from production. The stub details:

- Wells you’re paid on

- Volumes, prices, deductions

- Ownership decimal

Note: This is a key piece of information when selling mineral rights.

Net Revenue Interest / Net Decimal Interest / Owner Interest: Your share of production revenue (e.g., 0.001245) as found on your revenue statement. Calculated from your acreage and lease rate.

Drilling Unit / Spacing Unit / Pooled Acres: This refers to the group of acres combined to drill an oil or gas well(s). If your mineral rights are within the unit, you earn a share of the production—even if the well isn’t on your exact land.

Your royalty is based on how many net acres you own in the unit. For example, if you own 10 acres in a 640-acre unit, you get 10/640 of the production, multiplied by your lease royalty rate.

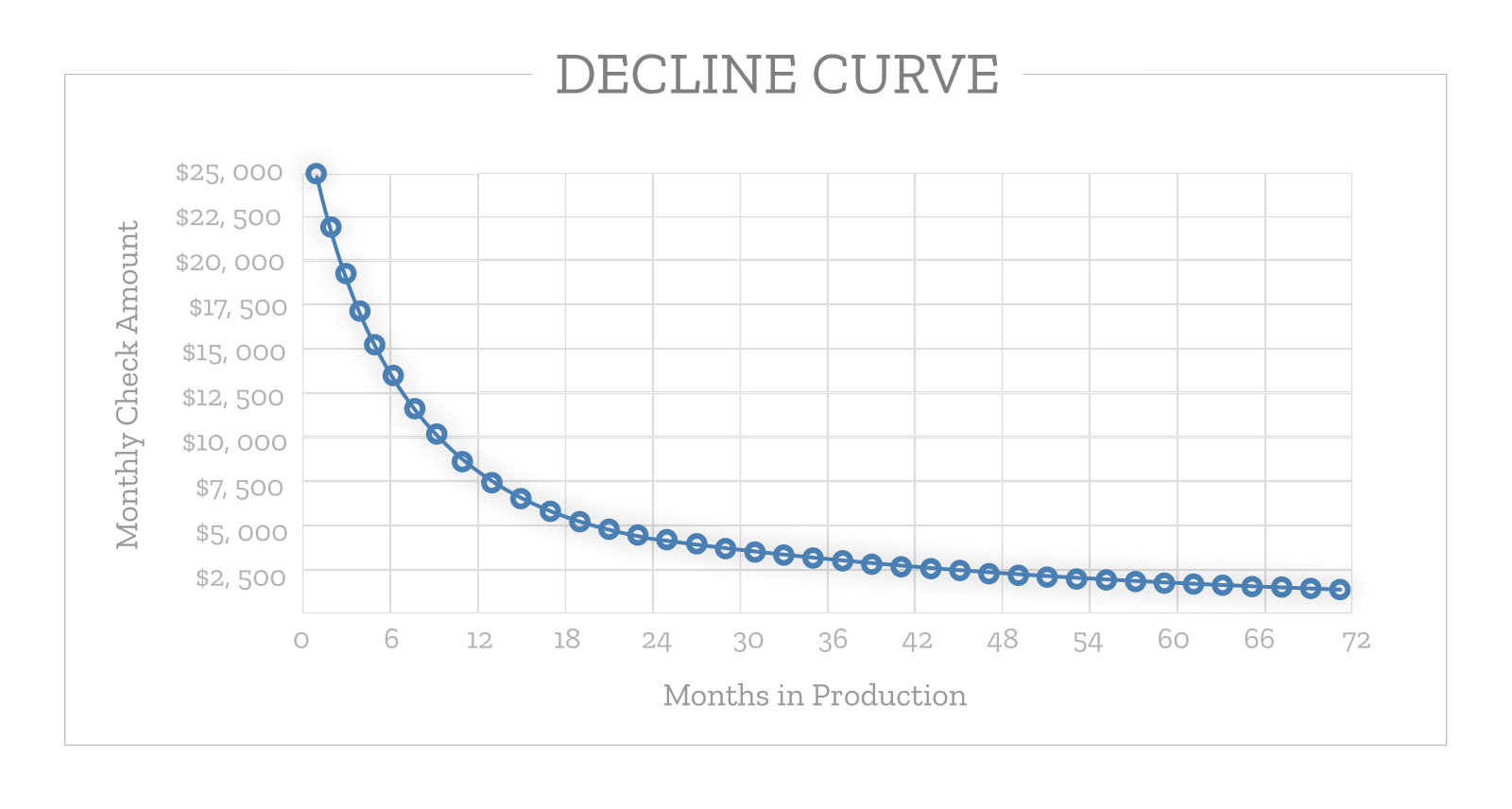

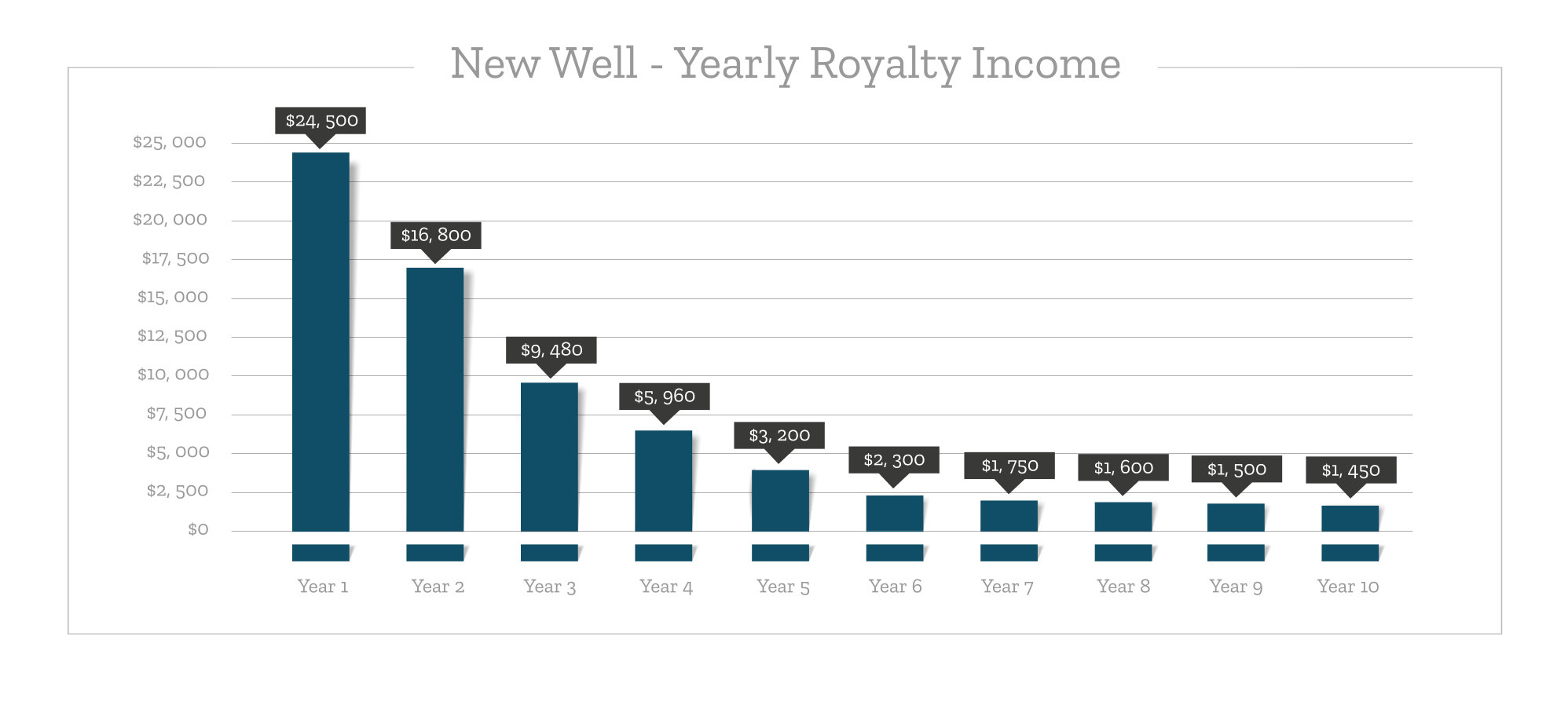

Production Decline Curve: Wells produce most in the first few years, then taper off. This curve shows how income will decrease over time.

Pay Status: You’re currently receiving royalties.

Suspense: Operators place royalties in suspense when there’s an issue—such as a title dispute or missing paperwork. If you’re not receiving expected payments, check with the operator to resolve the issue and release the funds.

Escheatment: If suspended royalties go unclaimed for too long, the state takes possession. To recover them, check your state’s unclaimed property website.

Gross Mineral Acre vs Net Mineral Acre: Gross mineral acres refer to the total size of a tract of land. For example, if a property is 160 acres, that’s the gross acreage. Net mineral acres are your individual share of that land. If the 160 acres were split among 16 heirs equally, each would own 10 net mineral acres.

You’re paid based on your net acres, not the gross total. The more net acres you own, the larger your share of lease bonuses and royalties.

Net Mineral Acre vs Net Royalty Acre: Mineral buyers will most often make offers on either a net mineral acre or net royalty acre basis. Net royalty acres are used to compare mineral rights across different royalty rates. This metric adjusts your net mineral acres to a standard 12.5% lease rate.

For example:

- 20 net mineral acres at a 12.5% royalty = 20 net royalty acres

- 20 net mineral acres at a 25% royalty = 40 net royalty acres

This helps buyers compare offers “apples to apples” based on income potential.

Purchase and Sale Agreement (PSA) / Letter of Intent (LOI): Purchase agreements used when selling your mineral rights. Review these carefully—they are legally binding.

Option Agreement: An option agreement gives a “buyer” the right—not the obligation—to purchase your minerals at a set price. It often ties up your property while the buyer tries to flip it for a profit, leaving you locked in with no guaranteed sale or upside. Options Agreements are not recommended.

Mineral and/or Royalty Deed: The legal document that transfers ownership of your mineral and royalty rights. Review closely before signing.

Landman: A title expert who researches records to confirm mineral ownership. Useful if you suspect you own minerals but have no proof. If you need to hire a landman, check out Western Land Services or findalandman.com

Final Note: Maximize the Value of Your Rights

Owning mineral rights can be a valuable asset—but only if you fully understand what you own. From identifying your interest type to knowing the current phase and reading your check stub, it all affects your income potential and property value.

Need help identifying your ownership or valuing your minerals?

Use the contact form below or click the green button for a free consultation. You can upload your latest check stub, and our team will walk you through your options.

The more you know, the more confident you can be in managing or selling your mineral rights.

Popular Content

- Sell Mineral Rights

- Mineral Rights Value

- Calculate Value

- Market Value

- Mineral Rights Buyers

- Mineral Rights Appraisal

- Mineral Rights Brokers

- Should you Sell Mineral Rights

- Never Sell Mineral Rights

- 10 Helpful Tips

- Mineral Interest Types Explained

- Common Mistakes

- Mineral Rights & Taxes

- Medicaid & Mineral Rights

- Common Q&A

Free Consultation

Free Consultation

Common Questions

The more information you can provide about your property the better! We can give you a better idea about the value of selling mineral rights if you provide more information. The most important thing we need is for you to answer the questions and provide your state and county.

If you have the required documents to list, providing those is extremely helpful!

Absolutely not! When you inquire at US Mineral Exchange we will not be putting any pressure on you to sell. We will help answer any questions you have whether you are interested in selling or not.

At US Mineral Exchange, we take privacy very seriously. We will NEVER sell your information or use it without your consent. When you send us documentation or tell us about your property, that information does not go outside our company without your consent. Even when you list a property for sale on our website, we strictly control who has access to the information about your listing so that only legitimate buyers will be able to see property details.

Many mineral owners make the mistake of getting an offer and quickly selling. They then accept an offer far below market value because they felt pressure to sell. There is nearly always a better price available.

Imagine you were selling a home. Would you get the best price from a random person who walks up and makes you an offer? No way! Now imagine you list the home on the MLS where thousands of potential buyers know your house is for sale. The key to getting the best price is competition. Our guide to selling mineral rights explains everything.

The reason that so many mineral owners decide to sell mineral rights at US Mineral Exchange is access to our large network of mineral rights buyers. Our goal is to help you get top dollar for selling mineral rights by getting your property in front of a huge audience of buyers. This allows buyers to compete against one another which ensures you get fair market value for selling mineral rights.

There are absolutely no cost to list your property. When you locate a buyer by listing your property with us, we are paid a commission directly by the buyers closing agent. This means you never have any out of pocket expenses ever. We only get paid if we can get you a better price than the current offer you have in hand.

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.