Mineral Rights Appraisal Service

Are you trying to determine the value of your mineral rights? Many mineral owners look for a mineral rights appraisal service, thinking it works like a home appraisal. While the idea seems reasonable, the reality is very different.

Mineral rights appraisals fail to reflect true market value.

In this article, we’ll explain why traditional mineral rights appraisal services often fall short and what to do instead.

Home appraisals are based on comparable property sales, making it relatively simple to estimate value. Mineral rights, on the other hand, are far more complex. Market value depends on many fluctuating factors—such as production, location, commodity prices, and future drilling potential.

While mineral rights appraisal services exist, they rarely offer an accurate reflection of what your minerals are worth in today’s market.

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.

Garrett Phelan

CEO of US Mineral Exchange with over 27 years of experience in the oil and gas industry. For nearly two decades, he has helped individuals, families, trusts, and non-profits navigate the complexities of mineral and royalty rights to achieve the highest sale prices.

Widely recognized as an industry expert, with an unwavering commitment to a client-first philosophy and extensive industry knowledge, he has been featured in Hart Energy, Yahoo Finance, and the Permian Basin Petroleum Association magazine.

Cash Flow Value vs Future Value

When you receive a mineral rights appraisal, the estimate usually reflects two components:

- Cash Flow Value – The current royalty income your mineral rights generate

- Future Value – The projected income based on future production and potential new wells

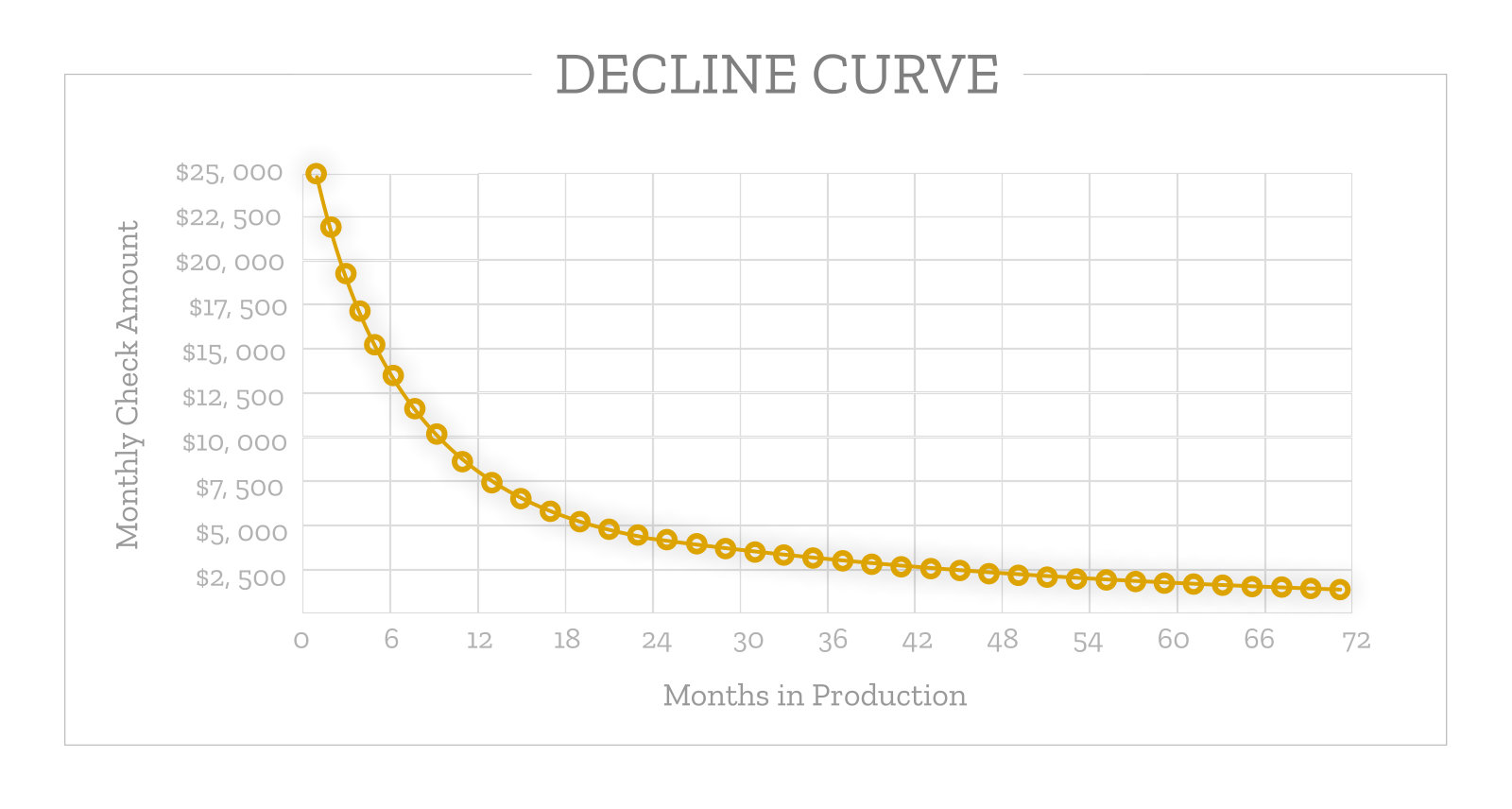

The cash flow value is relatively straightforward. Appraisers can estimate how long your current income might last using production data and decline curves. For example, if you’re receiving $10,000 per year, a common estimate might be 4 to 6 years of income—so $40,000 to $60,000 in estimated value.

Future value, however, is much harder to predict. It depends on many unknowns, including:

- The future price of oil and gas

- When (or if) new wells will be drilled

- Whether production will be shut in

- Long-term production trends over decades

These unknowns make long-term forecasting extremely unreliable. That’s why the future value portion of most mineral rights appraisals is speculative at best.

In the short term, it’s possible to make a reasonably accurate estimate based on how long a well has been producing and a few key assumptions. Appraisers can model royalty income for the next few years using known production data and current oil and gas prices.

However, forecasting beyond that gets much more difficult.

What will oil prices look like in five or ten years? How long will it take before a new well is drilled—if it happens at all? What if a well is unexpectedly shut in? These unknowns make long-term projections highly unreliable.

This is where most mineral rights appraisals fall short. They rely heavily on long-range forecasts that often turn out to be wrong. In the next section, we’ll examine how appraisal services typically estimate future value—and why that method rarely reflects real-world market conditions.

Mineral Rights Appraisals – Estimating Future Value

Most mineral rights appraisal services aim to calculate the total value of your interest based on the assumption that all oil and gas will eventually be extracted. This method heavily depends on what’s called the Estimated Ultimate Recovery (EUR)—a projection of how much oil and gas lies beneath your land.

However, this approach creates several problems:

-

EURs Are Just Estimates

Even large, publicly traded oil and gas companies often miss the mark when estimating EURs. As highlighted by the Wall Street Journal, entire regions sometimes underperform compared to initial projections. If the foundation of the appraisal is flawed, the final valuation will be inaccurate. -

Oil and Gas Prices Fluctuate

Many mineral owners assume prices will rise over time. That might happen—or they could fall. The growing shift toward renewable energy continues to reduce long-term demand for fossil fuels. As prices swing, the potential revenue from your minerals changes dramatically. -

Time Value of Money Matters

Even if your minerals are worth $250,000 based on current oil prices, you won’t collect that money all at once. It may take decades to fully extract and sell the resources. A buyer won’t pay $250,000 today to recover that amount over 20 years. Instead, they’ll discount the value to account for the time, risk, and uncertainty involved. -

Appraisals Can Be Very Costly

In addition to being unreliable, many mineral rights appraisals are expensive. It’s not uncommon to spend thousands of dollars on an appraisal that offers little real-world value. In nearly every case, the cost significantly outweighs the benefit.

Given these factors, most mineral rights appraisals fail to reflect actual market value. Even if the estimate happens to be close, that number can become outdated in just a few months due to changing oil prices or drilling activity.

Our Experience with Mineral Rights Appraisals

At US Mineral Exchange, our goal is to help mineral owners get the highest possible value when selling mineral rights. Over the years, we’ve tested many appraisal services to see if they could support that mission.

We submitted properties—ones we later sold through competitive bidding—to several appraisal providers. In every case, the appraised values were:

-

Significantly higher than actual market value, or

-

Nowhere near what the property ultimately sold for

If mineral rights appraisal services could accurately predict fair market value, they would simply buy minerals slightly below that estimate and resell them for profit. But that doesn’t happen—because the values they provide aren’t reliable.

If a mineral rights appraisal service could accurately tell you the market value, those services could make a fortune by simply modeling the value, offering mineral owners slightly less and making a huge amount of money selling at fair market value. The reality is that these mineral rights appraisals do not accurately or consistently estimate true market value.

We had hoped these services could be used as tools to help mineral owners make informed decisions. Unfortunately, none of them consistently aligned with what real buyers were willing to pay.

That’s why we believe most mineral rights appraisals offer little to no practical value—especially when compared to what the open market can reveal.

How to Appraise Mineral Rights

The purpose of a mineral rights appraisal is simple: to estimate what your property is worth. Most mineral owners seek an appraisal because they want to avoid selling below market value. That’s a smart goal—but getting there requires the right approach.

The most accurate way to appraise mineral rights is through legitimate offers from real buyers. An actual offer is a market-based reflection of what someone is willing to pay right now. It provides far more accuracy than any hypothetical appraisal.

At US Mineral Exchange, we help mineral owners secure true market value by creating competition. Instead of relying on one offer, we market your property to thousands of qualified mineral buyers. These buyers compete, which drives the price higher and gives you a clear picture of what your mineral rights are truly worth.

If you want an accurate valuation—and the highest possible sale price—this competitive approach is the best mineral rights appraisal you can get.

Mineral Rights Appraisal for Medicaid Qualification

Some mineral owners seek an appraisal to help qualify for Medicaid. In this situation, the value of your mineral rights may affect your eligibility.

However, be cautious—many mineral rights appraisals are inaccurate and can work against you. An inflated value might disqualify you, while an undervalued estimate can raise legal concerns later.

We recommend reviewing our full article on mineral rights and Medicaid to understand how these assets are valued for eligibility. Every state has its own rules, so it’s important to evaluate your situation carefully.

Free Consultation

If you’re unsure what your mineral rights are worth or have questions about mineral rights appraisals, we’re here to help.

At US Mineral Exchange, we speak with mineral owners every day. Whether you’re planning to sell, evaluating your options, or simply want a second opinion, our team offers free, no-obligation consultations.

Fill out the contact form below, and a member of our team will respond quickly to provide clear, honest guidance.

Popular Content

- Sell Mineral Rights

- Mineral Rights Value

- Calculate Value

- Market Value

- Mineral Rights Buyers

- Mineral Rights Appraisal

- Mineral Rights Brokers

- Should you Sell Mineral Rights

- Never Sell Mineral Rights

- 10 Helpful Tips

- Mineral Interest Types Explained

- Common Mistakes

- Mineral Rights & Taxes

- Medicaid & Mineral Rights

- Common Q&A

Common Questions

The more information you can provide about your property the better! We can give you a better idea about the value of selling mineral rights if you provide more information. The most important thing we need is for you to answer the questions and provide your state and county.

If you have the required documents to list, providing those is extremely helpful!

Absolutely not! When you inquire at US Mineral Exchange we will not be putting any pressure on you to sell. We will help answer any questions you have whether you are interested in selling or not.

At US Mineral Exchange, we take privacy very seriously. We will NEVER sell your information or use it without your consent. When you send us documentation or tell us about your property, that information does not go outside our company without your consent. Even when you list a property for sale on our website, we strictly control who has access to the information about your listing so that only legitimate buyers will be able to see property details.

Many mineral owners make the mistake of getting an offer and quickly selling. They then accept an offer far below market value because they felt pressure to sell. There is nearly always a better price available.

Imagine you were selling a home. Would you get the best price from a random person who walks up and makes you an offer? No way! Now imagine you list the home on the MLS where thousands of potential buyers know your house is for sale. The key to getting the best price is competition. Our guide to selling mineral rights explains everything.

The reason that so many mineral owners decide to sell mineral rights at US Mineral Exchange is access to our large network of mineral rights buyers. Our goal is to help you get top dollar for selling mineral rights by getting your property in front of a huge audience of buyers. This allows buyers to compete against one another which ensures you get fair market value for selling mineral rights.

There are absolutely no cost to list your property. When you locate a buyer by listing your property with us, we are paid a commission directly by the buyers closing agent. This means you never have any out of pocket expenses ever. We only get paid if we can get you a better price than the current offer you have in hand.

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.