Common Mineral Owner Mistakes

There are many ways mineral owners can be taken advantage of during the selling process. Unfortunately, most never realize it—or they discover the mistake when it’s too late to fix it.

At US Mineral Exchange, we’ve seen these situations firsthand. Over the years, we’ve watched mineral owners fall into the same traps again and again. The good news? These mistakes are avoidable.

When you list with US Mineral Exchange, you gain access to industry experts who help you steer clear of these pitfalls. We’ll help you get the best price possible and ensure a smooth, secure closing process.

Before selling your mineral rights, take time to review the most common mistakes mineral owners make. Some of these are easy to avoid on your own. Others require expert guidance to detect and prevent.

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.

Garrett Phelan

CEO of US Mineral Exchange with over 27 years of experience in the oil and gas industry. For nearly two decades, he has helped individuals, families, trusts, and non-profits navigate the complexities of mineral and royalty rights to achieve the highest sale prices.

Widely recognized as an industry expert, with an unwavering commitment to a client-first philosophy and extensive industry knowledge, he has been featured in Hart Energy, Yahoo Finance, and the Permian Basin Petroleum Association magazine.

Content

- Mistake #1: Selling Mineral Rights on Your Own

- Mistake #2: Accepting the First Offer

- Mistake #3: Working with a Mineral Rights Flipper

- Mistake #4: Choosing the Wrong Mineral Rights Broker

- Mistake #5: Purchase and Sale Agreement

- Mistake #6: Not Understanding Market Value

- Mistake #7: Misunderstanding Flush Production and Decline Curves

- Mistake #8: Trying to Navigate the Sale Alone

- Have Questions About Your Mineral Rights?

Mistake #1: Selling Mineral Rights on Your Own

We’ll admit—we’re biased. Our team helps mineral owners sell mineral rights every day, and we believe strongly in what we do. But even setting our bias aside, trying to sell mineral rights on your own is the biggest mistake you can make.

Why? Because it usually means you’ll make less money.

Selling mineral rights yourself seems simple. You get offers in the mail, search online for buyers, and pick the highest bid. Sounds easy, right? Not so fast. When you sell on your own, you’re only reaching a small fraction of potential buyers. Most mineral owners compare a handful of offers and assume the highest one is fair. Unfortunately, that “high” offer might be tens, or even hundreds of thousands of dollars below market value.

The only way to truly maximize value is to create competition. When buyers compete for your mineral rights, they are forced to make their best offer. Without that bidding environment, you’ll never know how much your property is really worth.

Mistake #2: Accepting the First Offer

This is one of the most common mistakes we see.

Many mineral owners receive a single unsolicited offer and feel pressured to accept it right away. It might seem like a fair deal—especially if you weren’t actively planning to sell—but in almost every case, it’s not even close to the best offer available.

Think about selling a home. If only one buyer knocks on your door, you won’t get top dollar. But if your home is listed publicly and dozens of buyers compete, the price goes up. Mineral rights work the same way. Accepting the first offer almost always means walking away from money that should have gone to you.

Buyers often use urgency to rush you into signing. Take your time, gather multiple bids, and create competition to get the best possible price.

Mistake #3: Working with a Mineral Rights Flipper

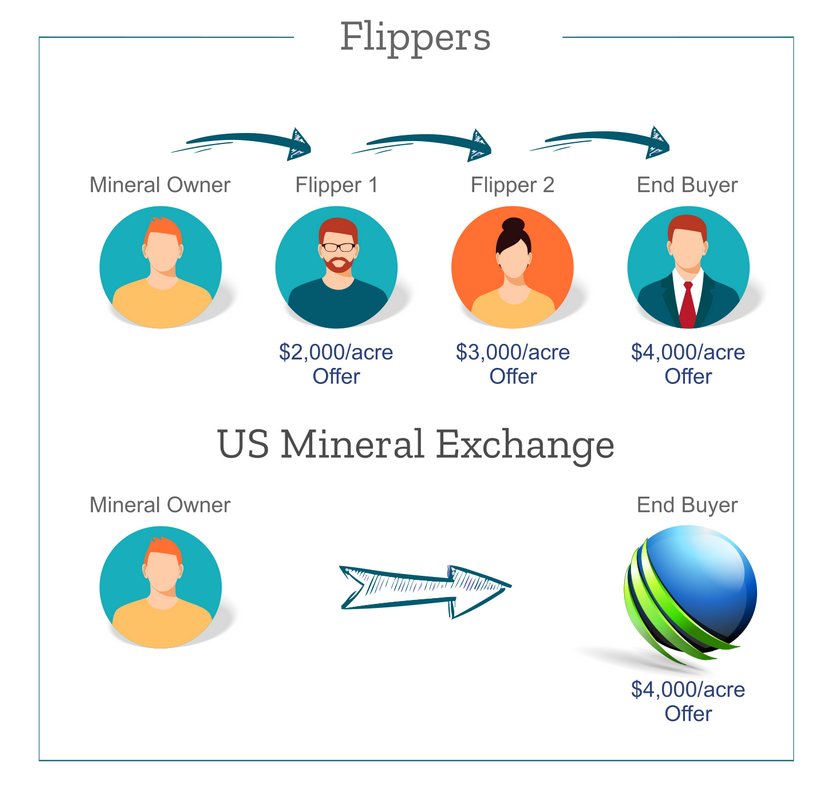

Flipping isn’t just for real estate—it happens in mineral rights too.

A mineral rights flipper is someone who pretends to be the end buyer. They get you under contract at a low price, then resell that contract to a real buyer at a higher price. You end up with less money, and they pocket the difference—often tens or even hurdreds of thousands of dollars.

To make things worse, flippers rarely tell the truth. They’ll claim they’re the buyer, then suddenly introduce a “partner” to close the deal. In many cases, there are several flippers involved in a single transaction, each taking a cut of your deal.

It’s extremely difficult to identify a flipper unless you know the industry. At US Mineral Exchange, we screen buyers carefully to ensure you’re working with a legitimate end buyer—not someone looking to profit off your lack of experience.

Mistake #4: Choosing the Wrong Mineral Rights Broker

Hiring a broker is a smart move—but not all brokers are created equal.

Some so-called brokers are actually mineral buyers in disguise. They create websites that look like marketplaces, then present offers that come from their own company. You think you’re getting multiple bids, but it’s really just one offer dressed up as competition.

To protect yourself, look for these red flags:

NO Listings: A real marketplace will display current listings for buyers to review.

Lack of helpful content: A trustworthy broker provides educational content and transparency.

Lack of specialization: Avoid brokers who handle all types of royalties (wind, solar, timber, etc.). You need someone focused solely on oil and gas mineral rights.

Fake Valuations: No broker can give you a precise market value up front. True value is determined by competition, not guesswork.

Proven Experience: It’s now extremely easy to set up a basic website and appear legitimate. Find out how long the company has been in business.

Industry Expertise: Choose a broker with proven industry expertise who is widely recognized as a trusted expert in mineral rights transactions. At US Mineral Exchange, our team has been featured in industry-leading publications and is known for helping mineral owners get maximum value.

At US Mineral Exchange, we’ve specialized in mineral rights since 2012. We exist to help you get the best deal—not to buy your minerals behind the scenes.

Mistake #5: Purchase and Sale Agreement

The purchase and sale agreement (PSA) is one of the most critical steps when selling mineral rights—and also one of the most overlooked. Many mineral owners get taken advantage of because they don’t fully understand the terms of the PSA.

For example, do you know the difference between a net mineral acre (NMA) and a net royalty acre (NRA)? Do you know how a PSA based on net decimal interest (NDI) can affect closing adjustments? Are you comfortable evaluating due diligence periods or understanding your legal recourse if a buyer doesn’t close?

Most mineral owners aren’t—and that’s where problems begin.

At US Mineral Exchange, a key part of our value is helping you navigate the PSA. We know the red flags to look for and how to protect your interests. Even experienced attorneys can miss important issues if they aren’t familiar with mineral rights transactions. That’s why having a trusted industry expert on your side is essential.

We review every PSA for potential problems, explain each term clearly, and ensure your agreement is fair and transparent before moving forward.

Mistake #6: Not Understanding Market Value

One of the most common mistakes mineral owners make is misunderstanding how market value works. Many believe their mineral rights are worth a future potential—not the actual price a buyer is willing to pay today.

Here’s the truth:

Market value is determined by what a mineral buyer is willing to pay right now, based on current royalty income, oil and gas prices, and drilling potential. Buyers do not pay for what might happen in five or ten years. They base their offers on existing production and the risks involved.

We often hear things like, “The price of oil will go up,” or “There’s a new pipeline coming soon.” These future projections may sound hopeful, but they don’t increase your property’s market value today.

Oil and gas is a boom-or-bust industry. We’ve seen values soar one year and collapse the next. That’s why understanding present-day value is so important.

At US Mineral Exchange, we put your property in front of a large network of verified buyers to generate true market competition. That’s how you discover the real value of your mineral rights—not through guesswork or future speculation.

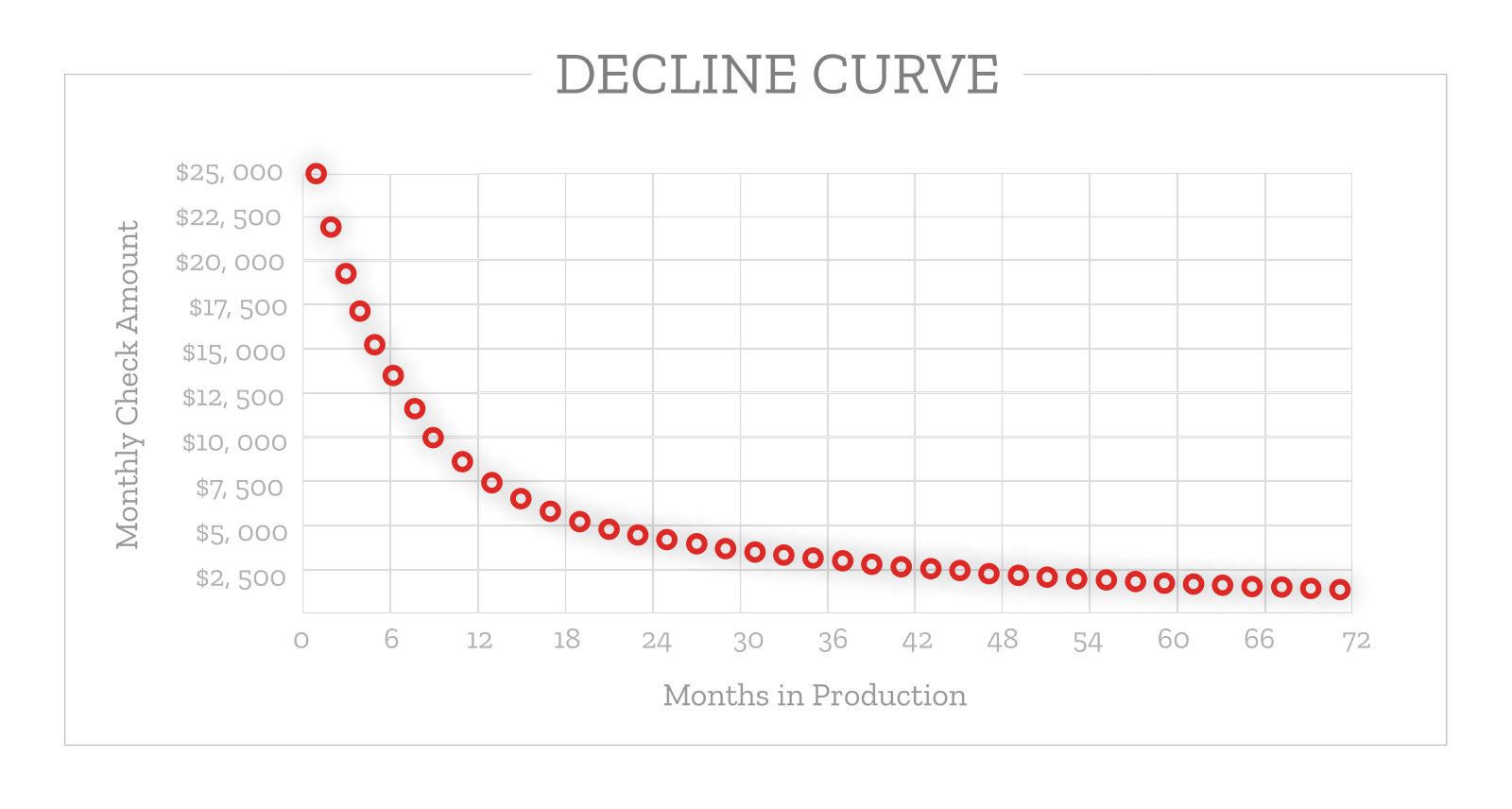

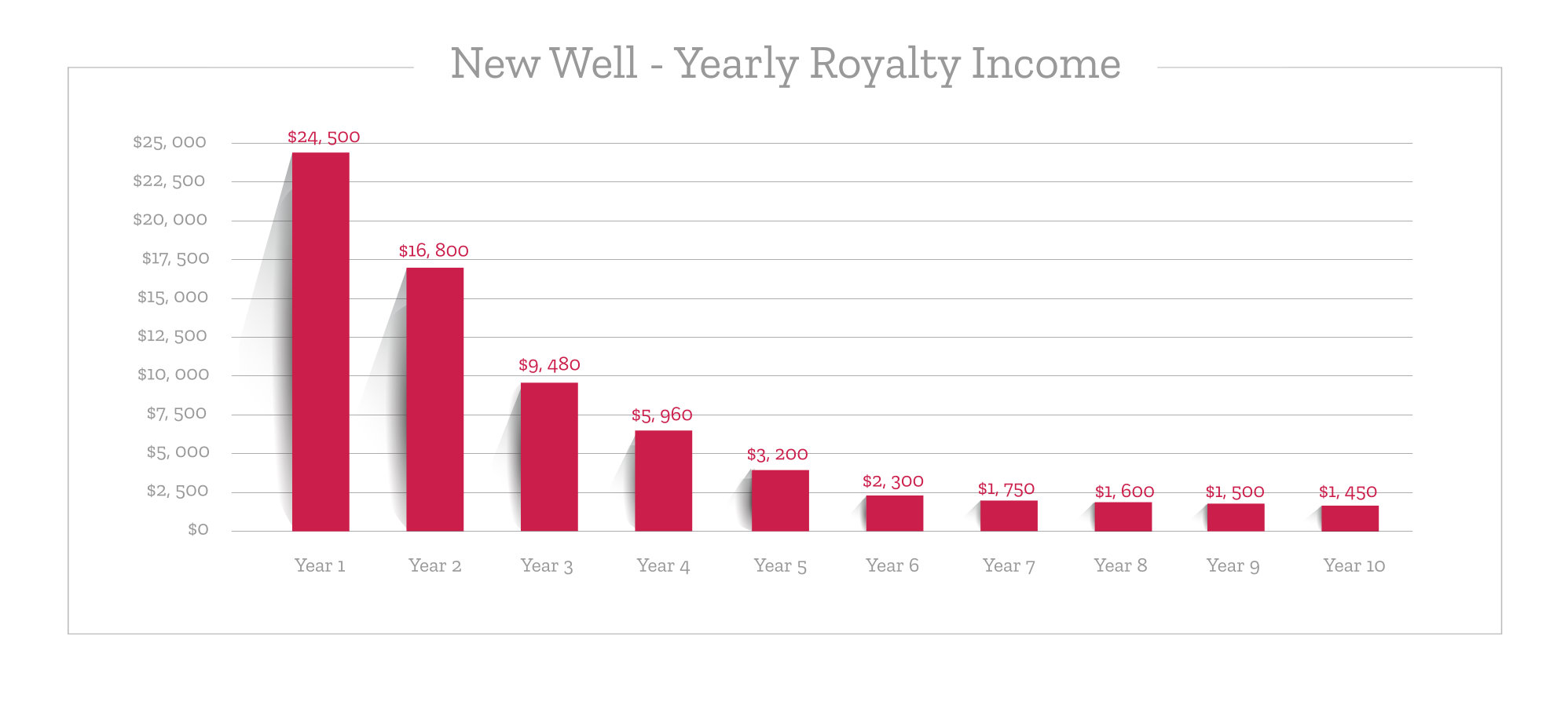

Mistake #7: Misunderstanding Flush Production and Decline Curves

If you’ve recently started receiving royalty income from a new well, it’s essential to understand how production declines over time. Many mineral owners see large royalty checks during the first few months and assume the high income will last. That assumption leads to unrealistic expectations and missed opportunities.

New wells begin with a period called flush production. This occurs when hydraulic fracturing releases a large volume of oil and gas quickly. During this time, royalty checks are at their highest. However, production typically declines sharply the first few months, depending on your location.

After the initial drop, production levels out and continues to decline gradually over decades. That means the $25,000 check you received in year one might drop to a fraction of that amount in just a few years.

Some mineral owners decide to sell during year 2 or 3 after collecting strong income. They look back at old offers and feel disappointed when current offers are lower. But once the oil is out of the ground, it’s gone. Buyers calculate offers based on future income potential—not past royalty checks.

To avoid this mistake, understand that the market value reflects what a buyer is willing to pay today, based on remaining production and current conditions.

Mistake #8: Trying to Navigate the Sale Alone

Many mineral owners underestimate how easy it is to make costly mistakes when selling mineral rights. From falling for lowball offers to trusting flippers or signing unfair purchase agreements, it’s easy to leave thousands of dollars on the table—or worse.

By listing your mineral rights at US Mineral Exchange, you gain a trusted partner with unmatched industry expertise. We help you:

- Avoid common pitfalls that cost mineral owners money

- Access a large network of serious, qualified buyers

- Create competition that drives up the final sale price

- Navigate every step of the transaction with confidence

Our team is widely recognized as a leader in mineral rights transactions. With over a decade of experience and features in major industry publications, we know how to protect your interests and help you get top dollar.

Have Questions About Your Mineral Rights?

We’re here to help. At US Mineral Exchange, we speak with mineral owners every day and understand the challenges you face. If you have questions or need guidance, don’t hesitate to reach out. Simply fill out the form below and a member of our friendly, knowledgeable team will get back to you quickly.

Popular Content

- Sell Mineral Rights

- Mineral Rights Value

- Calculate Value

- Market Value

- Mineral Rights Buyers

- Mineral Rights Appraisal

- Mineral Rights Brokers

- Should you Sell Mineral Rights

- Never Sell Mineral Rights

- 10 Helpful Tips

- Mineral Interest Types Explained

- Common Mistakes

- Mineral Rights & Taxes

- Medicaid & Mineral Rights

- Common Q&A

Common Questions

The more information you can provide about your property the better! We can give you a better idea about the value of selling mineral rights if you provide more information. The most important thing we need is for you to answer the questions and provide your state and county.

If you have the required documents to list, providing those is extremely helpful!

Absolutely not! When you inquire at US Mineral Exchange we will not be putting any pressure on you to sell. We will help answer any questions you have whether you are interested in selling or not.

At US Mineral Exchange, we take privacy very seriously. We will NEVER sell your information or use it without your consent. When you send us documentation or tell us about your property, that information does not go outside our company without your consent. Even when you list a property for sale on our website, we strictly control who has access to the information about your listing so that only legitimate buyers will be able to see property details.

Many mineral owners make the mistake of getting an offer and quickly selling. They then accept an offer far below market value because they felt pressure to sell. There is nearly always a better price available.

Imagine you were selling a home. Would you get the best price from a random person who walks up and makes you an offer? No way! Now imagine you list the home on the MLS where thousands of potential buyers know your house is for sale. The key to getting the best price is competition. Our guide to selling mineral rights explains everything.

The reason that so many mineral owners decide to sell mineral rights at US Mineral Exchange is access to our large network of mineral rights buyers. Our goal is to help you get top dollar for selling mineral rights by getting your property in front of a huge audience of buyers. This allows buyers to compete against one another which ensures you get fair market value for selling mineral rights.

There are absolutely no cost to list your property. When you locate a buyer by listing your property with us, we are paid a commission directly by the buyers closing agent. This means you never have any out of pocket expenses ever. We only get paid if we can get you a better price than the current offer you have in hand.

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.